Traders employ a variety of tools in order to conduct a detailed market analysis. A trend line is one of these tools. The incline on a sequential sequence of candlesticks is indicated by the line drawn on the chart. The trend line may serve as the foundation for a trading strategy. And in today's article, we'll look at how to use trend lines to trade pullbacks.

Trendlines

A trend line is a line that connects price lows and highs. If the price makes a low, then a high, and then a higher low, you can join the lows to build a trend line that shows the price's upward trajectory.

The price will produce a high, a low, and then a lower high during the downtrend. By linking the highs, you'll get a trend line.

How to trade Trendlines

The trend line can be used to determine the optimum points to open your trading position. You must wait until the candle touches the trend line for the third time before proceeding. During an uptrend, buy when the trend line is touched by a candle for the third time, and sell when the trend line is touched by a candle for the fourth time.

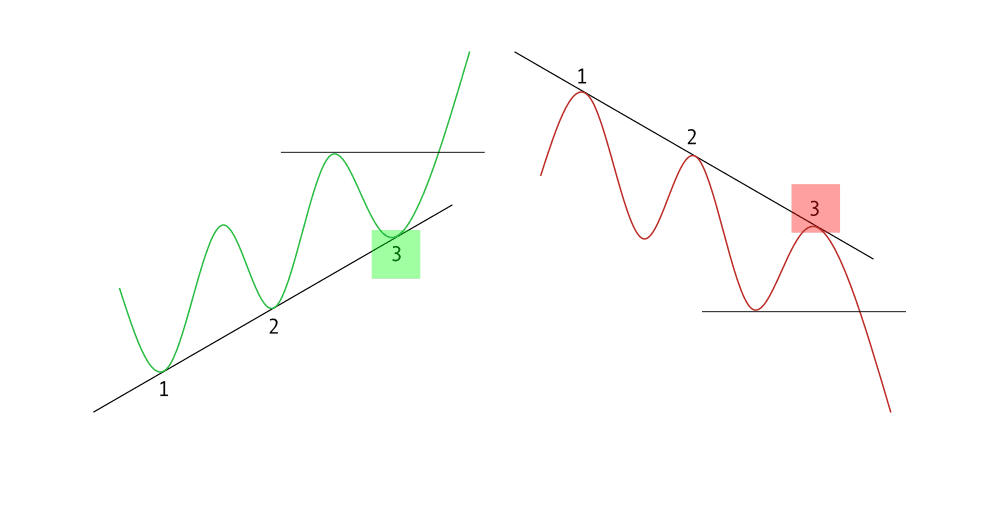

Consider the illustration below.

The first situation depicts an upward tendency. The first and second points will assist you in drawing the trend line. The third point is where a purchase position should be opened.

In the second instance, the downtrend is illustrated. Similarly, the first and second points are utilized to identify a trend line. When the candle touches the line in the point referred to as number 3, open a sell position.

Look for more candlestick patterns like engulfing candle or wicked candle to confirm your stance.

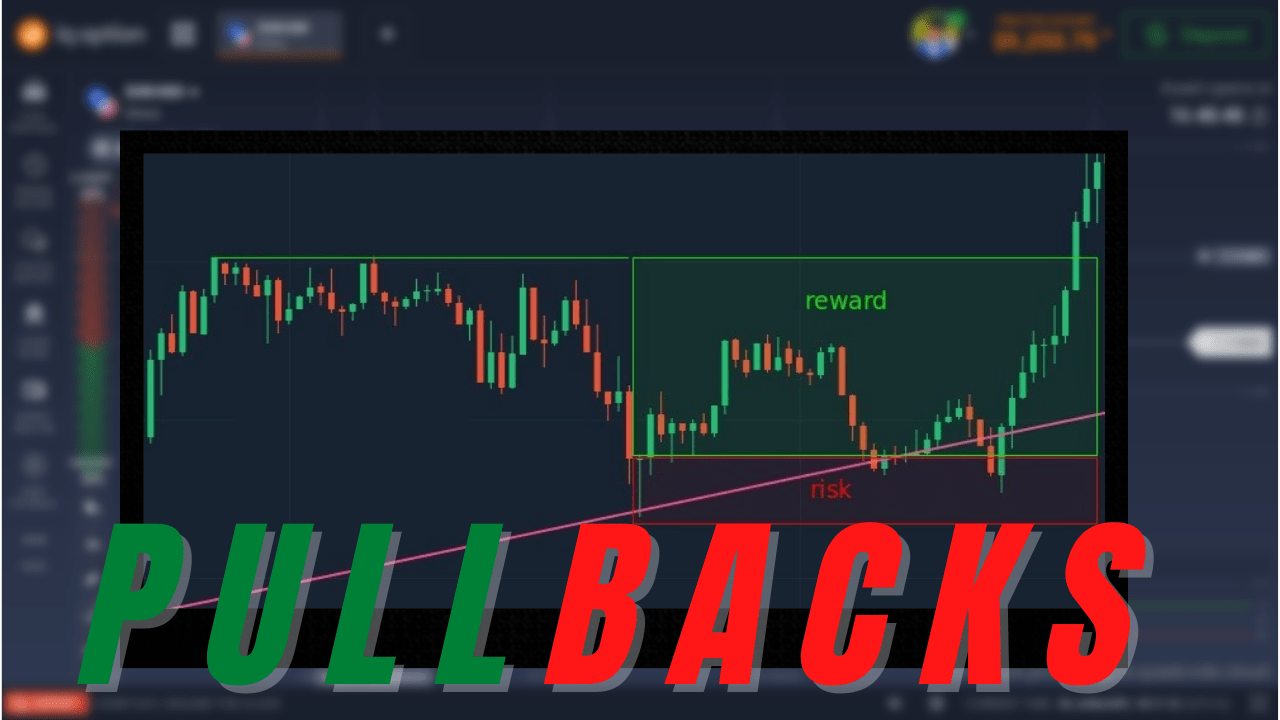

Pullback strategy for long trades

Take a look at the example chart below. On the chart, you can observe the lowest point. The price then begins to rise, eventually creating a higher low. A trend line is formed by connecting the lows. Now is the time to wait for a pullback to the trend line. Have you seen this powerful bullish pin bar (3)? This is an ideal time to go long.

Where to place your stoploss

Place your stop loss order below the trend line's pin bar. Take profit at the prior high level as a target. The higher the risk-to-reward ratio, the better.

Pullback strategy for short trades

You should wait for a downtrend to initiate a short trade. Look for the highest point, then the lowest point, and finally the lowest point. The trend line is created by connecting the highs. Your job now is to keep an eye on the chart and wait for the line to pull back. The bearish engulfing pattern appears on the trend line in the example below. You should start a short trade right now.

where to set your stop loss for short trade

Your stop loss should be placed immediately above the engulfing pattern. The take profit level should be set at the previous low. The reward to risk ratio is once again highly favorable.

Conclusion

Using trend lines to trade pullbacks is a basic method. You'll be able to master it in no time if you follow a few simple steps.

To begin, draw a trend line on the price chart by linking lows and highs.

After that, look for a retreat to the trend line, as well as an engulfing pattern or a wicked candle.

Set your stop loss and take profit levels after that. Calculate the reward-to-risk ratio. You'll want it to be quite high.

Also don't forget to check out some of my free forex tools here.

https://keithrainz.me/how-to-trade-pullbacks-full-guide/?feed_id=1120&_unique_id=64e9d89e4d837

Comments

Post a Comment